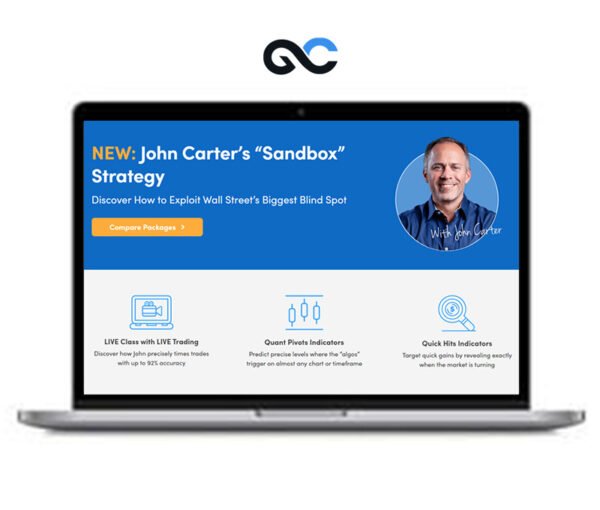

John Carter – New Sandbox Strategy 2023

Original price was: $897.00.$24.00Current price is: $24.00.

Download John Carter – New Sandbox Strategy 2023 (5.46 GB) in Mega Drive, In the ever-evolving landscape of financial markets, the Sandbox Strategy emerges as a beacon for human traders seeking to outmaneuver their algorithmic counterparts. By harnessing the power of Quant Pivots and Quick Hits, traders gain a nuanced understanding of algorithmic boundaries and exploit blind spots with precision.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

![]()